I have been looking at data from the MIX market recently. They provide a lot of financial data from microfinance institutions around the world. This data is made accessible to donors, but especially to other financiers of microfinance. It has helped us in the understanding of the state of the microfinance world, as it has become a central gathering point for data.

In recent years, more and more institutions started to disclose data on lending methodology. There are three categories. First “Solidarity lending”. It is not 100% clear, but from the glossary of terms on the MIX market website, I assume it means classical joint liability lending groups (JL). The other categories are “Individual lending” (IL) and “Village Banking”. A lot of early theoretical work has focused on the role that joint liability group lending had in context of classical problems  of adverse selection, moral hazard and ex-post moral hazard (enforcement problems).

Though in 2002 Grameen officially abandoned explicit joint liability and other institutions, such as BancoSol seemed to follow. So one interesting question is, whether institutions are shifting away from Joint Liability groups towards more Individual lending, or whether our perceptions are biased because two popular institutions have abolished explicit joint liability.

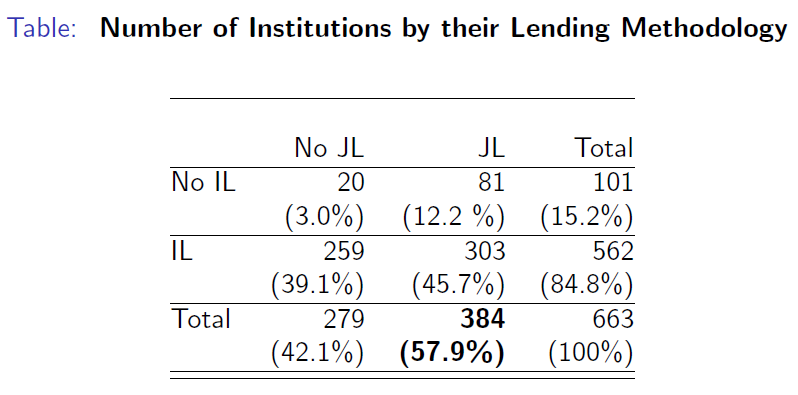

It turns out that in the MIX data for the year 2009, we observe that joint liability lending is still very much present. The following table tells us however, that a lot of institutions seem to offer both individual liability as well as joint liability loan products.

The institutions recorded as “No JL” and “No IL” are falling into the category of “Villagebanks”.

I think it is interesting to try to understand the patterns, why so many institutions use both joint liability groups and individual liability lending methods at the same time. Are there clear patterns as to when which method is predominantly used? Are for-profits more likely to use individual lending? What are the effects of competition?

Some very simple questions, which need yet to be answered.

Great post